How to Finance a MassageLuXe Franchise

When buying a franchise, the key number you need to pay attention to is the estimated initial investment. The estimated initial investment is the total estimated cost of opening a franchised location and includes the franchise fee, leasehold improvements, fixtures, equipment, supplies, grand opening marketing, estimated operating capital for the first few months, and more. The estimated initial cost to open a MassageLuXe massage spa franchise varies from $414,700 to $768,000. You can get a breakdown of the MassageLuXe startup costs here.

Don’t shy away from a franchise because of these numbers, as buying a franchise is very doable for most people. With the right financing strategies, most candidates can come up with several funding combinations to afford it. Most first-time franchise buyers use a combination of personal savings, SBA loans, conventional loan products, and 401(k) or traditional individual retirement account (IRA) rollovers.

Getting Started

The first step is to assess your franchise financing needs by accurately reviewing your existing financial situation. Most franchisors and lenders want a prospective franchisee to put some personal funds towards the initial investment. Typically, candidates will need 10 to 30 percent of the estimated initial investment in liquidity to take advantage of the many popular funding strategies available.

It is highly recommended that candidates reach out to a finance expert early in the process to begin prequalification conversations, as putting together the right financing strategy can take time.

Assessing your Liquidity Options

Your personal liquidity includes bank accounts and investments in brokerage accounts. One of the many tools that people are currently using is severance packages to secure franchise financing, as severance packages often include severance pay, unused vacation, sick pay, deferred compensation, and company stock and stock options that can be cashed in. There’s also the option to use equity in your home to secure franchising if it does not put your family’s financial security at risk.

If you are planning on using retirement funds, there is an option to do a 401(k) or traditional IRA rollover, also called Rollovers as Business Startups (ROBS). The ROBS rollover enables aspiring business owners to tap into their own retirement monies to fund their businesses, without paying taxes or early-withdrawal penalties. The business owner forms a new corporation and rolls the retirement funds over into a new 401(k) in the new corporation. Then, the new 401(k) invests in stock in the business owner’s own corporation.

The original retirement account is treated as a rollover. Therefore, no taxes or early-withdrawal penalties apply — provided all the i’s are dotted and the t’s crossed. ROBS are legal and the IRS says they are not an abusive tax avoidance strategy. This is not a good fit for everyone and should be done responsibly to ensure that you are not digging into your retirement funds too heavily.

Securing a Loan

To get a business loan, your credit score is key. The bare minimum is a credit score of 600, but to qualify for an SBA loan you will most likely need a score in the range of 640. A credit score of 700 and up will get you the largest number of financing options and best terms for a bank loan. Additionally, financial institutions typically require personal guarantees for small business loans. They may require collateral and a down payment as high as 20% to 25%.

SBA loans are made by lenders but backed by the U.S. government and can be used by franchisees. The U.S. Small Business Administration (SBA) establishes all requirements and generally guarantees 75% of the loan. The main type of SBA loan used for purchasing a franchise is the 7(a) program. Advantages are:

- A 7(a) loan can be used to open a new franchise business. Conventional lenders are often hesitant to lend to a startup with no track record of sales. But 7(a) loans can be based on future projections.

- The required down payment can be lower than conventional financing. Business owners can finance a significant chunk of the project costs – up to 90%.

- The maximum amount for a 7(a) loan is $5 million. The repayment term can be longer than conventional business loans – up to 10 years.

- Interest rates are often favorable.

- Veterans may be eligible for reduced fees under the Veterans Advantage Program.

One thing to note about the SBA 7(a) program is the lender is required to tie up your real estate as collateral by placing a lien on your home.

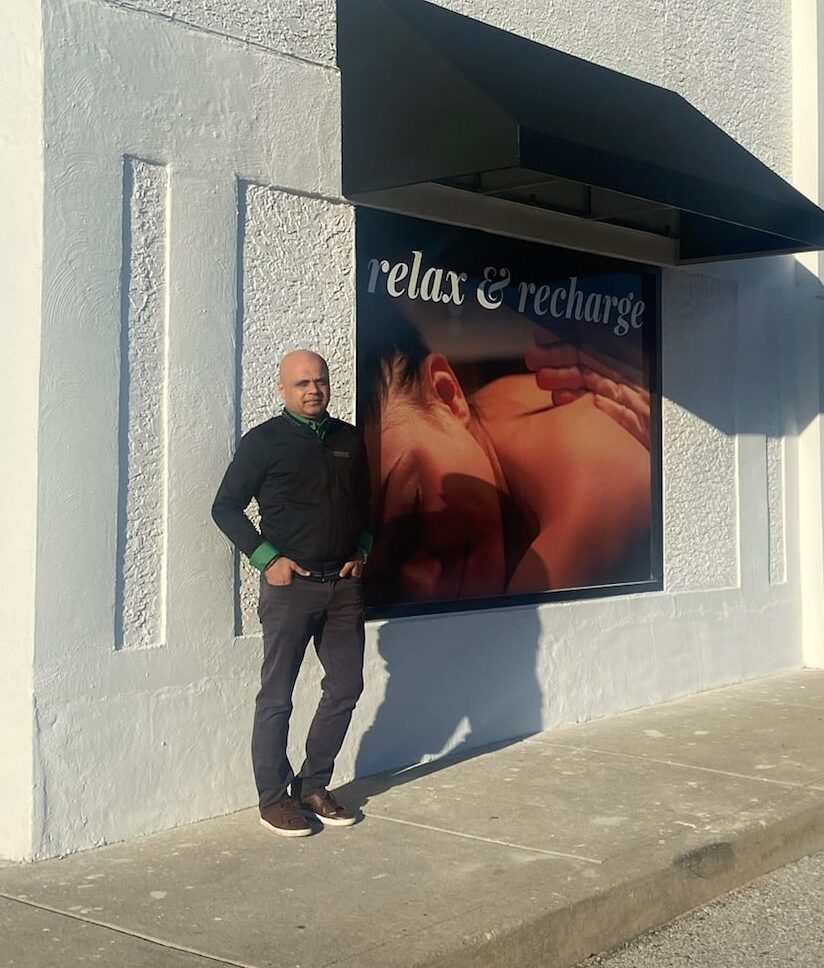

Ready to Start Your Own MassageLuXe Franchise?

Learn more about franchising with MassageLuXe here. If you’re interested in learning more about the process of becoming a franchise owner, read more about our process here. To start your journey of becoming a franchise owner with MassageLuXe, fill out our form here, and we’ll be in touch to start an introductory conversation. We look forward to learning more about your entrepreneurial goals and how we can help you achieve them with a MassageLuXe franchise!

* An offer to sell a franchise can only be made pursuant to a Franchise Disclosure Document (“FDD”). The above financial information is only a portion of the financial information contained in our FDD (in Item 19). You should thoroughly review our FDD with your professional advisor. If the FDD that was presented to you does not contain an Item 19 or if any of the above financial information is inconsistent with any information contained in Item 19 of that FDD, you cannot and should not rely on the above information and should contact us immediately in writing.